The Challenge & Our Solution

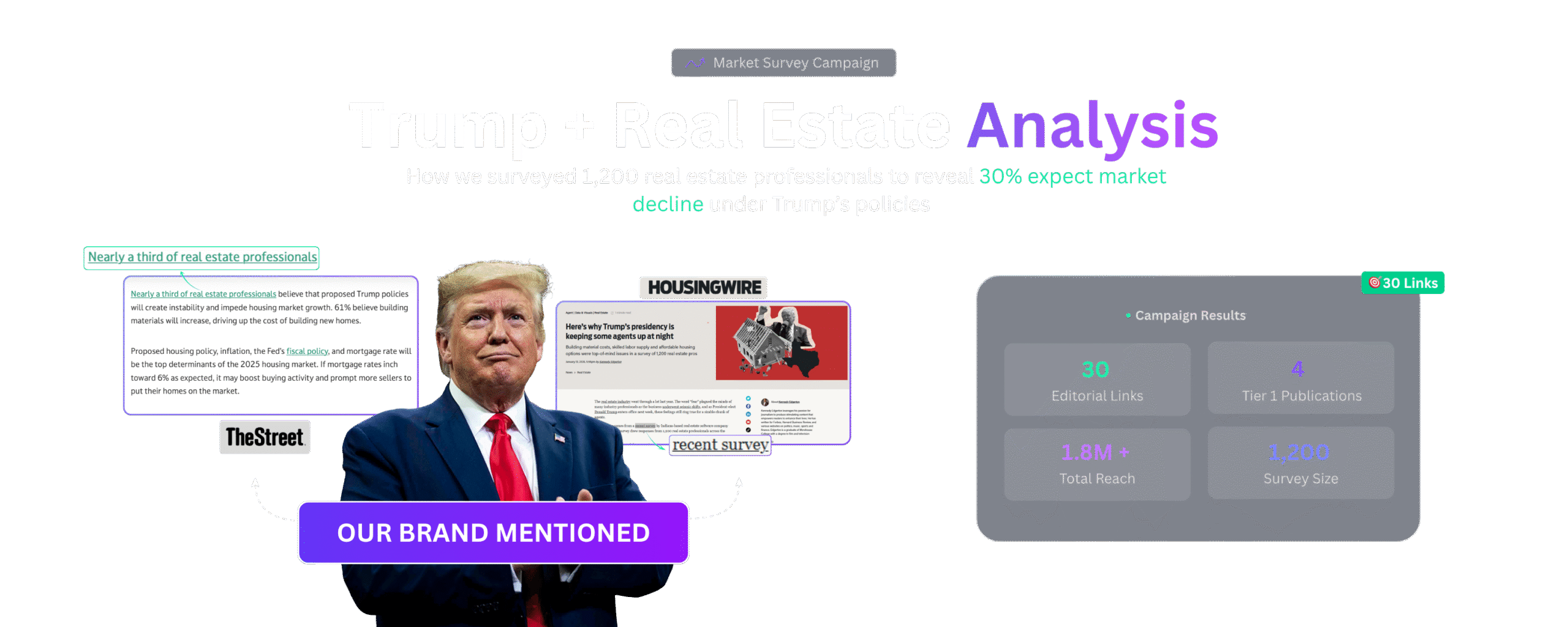

How we transformed political uncertainty into data-driven market insights that positioned REsimpli as the authoritative voice in real estate analysis.

The Challenge

Market Challenges:

- • Political uncertainty affecting market confidence

- • Need for credible, large-scale market research

- • Establishing authority in political-economic analysis

Our Solution

Strategic Advantages:

- Large-scale credible data (1,200 respondents)

- Newsworthy findings and statistics

- Expert positioning in political analysis

Publications Secured

High-authority placements that established REsimpli as the trusted source for real estate market analysis.

Survey Impact

This comprehensive survey established REsimpli as the authoritative voice in political-economic real estate analysis, generating significant media coverage and positioning the company as a go-to expert for market insights.

Complete Timeline: 12 Weeks

From launch to media authority in just 3 months

Week 1

Campaign Launch

Syndication Begins

Week 4

Phase 1 Complete

200+ Links Secured

Week 12

Phase 2 Complete

230+ Total Links

Weeks 1-4

Foundation building through strategic syndication

Weeks 5-12

Editorial features and tier-1 publication placements

Beyond Week 12

Ongoing benefits and compound authority growth

Key Market Insights

Comprehensive analysis of 1,200 real estate professionals revealing market expectations for Trump’s second term.

Market Impact Expectations

Nearly 30% of Americans expect Trump’s return to negatively impact the real estate market:

28.75% believe policies will bring negative changes to real estate

36.25% think policies will hurt market recovery through inflation and tariffs

27.08% expect decreased real estate investments due to economic instability

Construction & Materials

Widespread concerns about rising costs and labor shortages:

60.57% expect building material costs to increase significantly

46% believe skilled labor availability will be reduced

44.33% expect affordable housing market to decline due to rising costs

Financing & Investment

Mixed expectations on financing accessibility and foreign investment:

28.5% expect securing financing to become much tougher for first-time buyers

51.41% believe policies will reduce foreign investment in U.S. real estate

45% expect more competitive rates due to Fannie Mae/Freddie Mac privatization